|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Current 15 Year Refinance Rates: A Comprehensive GuideAs homeowners look to refinance their mortgages, the 15-year refinance rate remains a popular option. This guide will explore the current landscape, comparing various options to help you stay well-informed. Why Consider a 15 Year Refinance?Refinancing to a 15-year loan can significantly reduce your total interest payments. It's a strategic move for those looking to pay off their mortgage quicker and save money over time. Benefits of a 15-Year Term

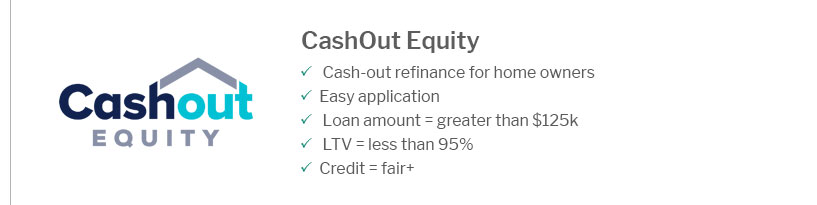

Comparison of Popular Refinancing OptionsDifferent mortgage loan companies in the USA offer various refinance packages. Understanding these can help you select the best option for your needs. Fixed vs. Adjustable RatesFixed rates provide stability with predictable payments, whereas adjustable rates might start lower but can increase over time. It's crucial to weigh these options carefully. For a detailed look at current options, visit mortgage loan companies in usa. Costs to Consider

Keeping Up with Rate ChangesUnderstanding the factors influencing rate changes is vital for timing your refinance. Economic IndicatorsInterest rates are often affected by broader economic factors such as inflation and Federal Reserve policies. Stay updated by checking resources like homeowners interest rate today. Market TrendsMonitoring market trends can give insights into the best times to refinance, potentially leading to greater savings. Frequently Asked Questions

https://www.usbank.com/home-loans/refinance/conventional-fixed-rate-refinance/15-year-fixed-refinance-rates.html

Check out current refinance rates for a 15-year conventional fixed-rate loan. These rates and APRs are current as of 03/21/2025 and may change at any time. They ... https://www.rocketmortgage.com/refinance-rates/15-year-refinance-rates

Compare our current refinance rates for 15-year fixed mortgages. VA loans are for eligible military. Jumbo loans are for mortgages starting at $766,550 and up ... https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; 30-year fixed - 6.750% - 6.949% ; 15-year fixed - 5.875% - 6.153% ; 5y/6m ARM variable - 6.750% - 7.175%.

|

|---|